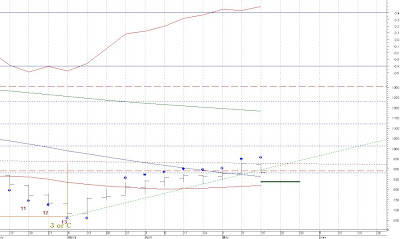

Is the L1 (Level 1) Alpha pulse high in? The odds favor that interpretation after yesterday’s downtrending price bar. However; the key continues to be the fact that we can’t have a significant high unless we break below last Tuesday’s low of 897.34.

Technically the biggest changes on the chart concern the TD Supply and Demand Lines. The TD Demand Line mentioned yesterday was broken and qualified at 918.99. That price action not only negated the TD Supply line target of 943.17 but gives us a downside target of 898.99. Keep in mind that this doesn’t mean the market can’t go lower. Otherwise, the new TD Supply line runs just under the previous highs.

Here is a full update of the current Draft Trading Plan:

Trading Philosophy (draft): The objective is to develop a mechanical trading system based on technical analysis and market cycle ideas. The system will have zero reliance on user input (i.e. a forecast or belief about future prices).

The success of the market cycle trades will depend on the size of the cycle. These are not predictable and so it is certain that some trades will lose money.

Technical analysis trades will only be taken in the direction of the current market cycle.

Trading Plan (draft):

The first objective is to protect and preserve capital

Every open trade must have an open protective stop-loss order

Never add to a losing position

Trend-Continuation Trade-Entry

Trend continuation trades will be taken on qualified breaks of TD Supply and Demand Lines. A trade can only be taken in the direction of the current Level 3 Price Pulse. These are the trades based on technical analysis. The maximum number of trend-continuation positions that may be held at any given time is two.

Trend-Reversal Trade-Entry

Trend-reversal trades will be taken when a new Level 3 Price Pulse begins. These are the trades based on market cycles. Only initiate a trend-reversal trade-entry when the market has signaled that the current Level 3 Price Pulse has completed and that a new Pulse (in the opposite direction) has begun. There can only be one trend-reversal position held at any given time. This trade strategy is essentially a stop and reverse strategy.

Trading Rules (draft):

Money Management

Trend-reversal trades: 40% of available account balance.

Trend-continuation trades: Each may be 20% of available account balance.

Position Risk

Each trade may only risk 3% of trade equity.

Position Size

This is determined as follows:

1) Money Management size = .4 X Account balance; or .2 X Account balance (depending on trade type)

2) Calculate the points at risk: the difference between the entry price and the initial stop-loss price.

3) Position Risk: Result from step 1 X .03

4) Position Size: Divide the result is step 3 by the result in step 2 and round down.

5) Dollar Amount for trade = result from step 4 X Entry Price

Example. $10,000 account balance. System indicates a Trend-reversal trade with entry price of 89.734; stop-loss level at 93.017.

1) 10000 x .4 = 4000

2) 93.017 – 89.734 = 3.283.

3) 4,000 x .03 = 120.

4) 120/3.283 = 36.551 rounded to 36

5) (36 x 89.734) = 3230.43

Trend-Reversal Trade-Entry

Trend-reversal trades are only made on those days; and at that price level, that confirm a new Level 3 price pulse has begun.

Initial Stop-loss on Trend-Reversal Trade

The initial protective stop-loss for this trade will be the most recent high or low.

Subsequent Stop-loss on Trend-Reversal Trade

The protective stop-loss will be brought to no further than one tick beyond the most current Level 2 Price Pulse high or low.

Trend-Reversal Trade-Exit

The trade is exited on a confirmed reversal in the Level 3 Price Pulse.

Trend-Continuation Trade-Entry

Trend-continuation trades are only made on those days that a TD Line in the direction of the current Level 3 Price Pulse is broken and qualified. The initial protective stop-loss for this trade will be the previous day’s high or low.

Trend-Continuation Profit Objective

This is calculated by using the TD Supply and Demand Lines

Subsequent Stop-loss on Trend-Continuation Trade

There are two trailing stop-loss levels.

1) Trailing Stop: 3-day high or low. Once the Price objective is reached use the 1-day high or low.

2) Current TD Demand/Supply line level contrary to the current trade

Trend-Continuation Trade-Exit

The trade will be exited at the protective stop-loss level.