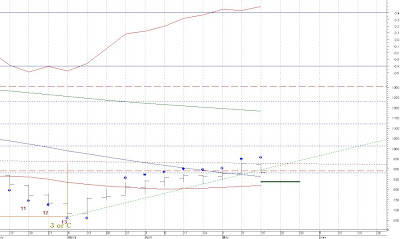

A downward trending week on the cash S&P500 has triggered several negative events. After breaking through TDST Resistance at 890.4 the week ending May 8, the break was not qualified as we failed to make a higher high this week. The S&P also negated the previously in-force TD Supply line bullish price objective by breaking below the TD Demand line this week at 895.42. We will qualify a price projection to 837.81 by breaking below 878.94 next week.

No comments:

Post a Comment